HD Hyundai Construction Equipment's mobile website is optimized for portrait (vertical) view.

Back to the List

HD Hyundai Construction Equipment Reports Q3 Operating Profit of 55.8 Billion Won, Up 30% Year-on-Year

2025-10-29

▶ Sales Reach 954.7 Billion Won, Up 17% Year-on-Year

▶ Increased Demand in Emerging Markets, Including Mining Equipment; Advanced Markets Also Showing Signs of Recovery

▶ “Aiming for Sustained Growth Through Specializing Production Across Global Bases and Tailored Product Portfolios by Sales Region”

On the 29th, HD Hyundai Construction Equipment announced that it recorded sales of 954.7 billion won and an operating profit of 55.8 billion won in the third quarter of 2025.

This marks a 17% year-on-year increase in sales, driven by surging demand in emerging markets, particularly for mining equipment, alongside a rebound in advanced markets. The operating profit rose by 30% year over year, supported by stronger sales and a product portfolio tailored to specific regions.

Regionally, advanced markets, particularly in North America and Europe, are seeing increased demand. Sales have benefited from higher sales of high-margin products, with Europe posting a remarkable 32% year-on-year increase and North America recording an 8% rise. Additionally, the After Market (AM) segment, which focuses on parts replacement and maintenance, has continued to improve profitability by diversifying its offerings, especially through a broader range of economical parts and oil sales.

In emerging markets, strong growth was observed across most regions, driven by heightened demand for mining equipment, ongoing infrastructure investments, and a robust construction sector. Notably, Africa saw an astonishing 216% increase in sales compared to the previous year, with significant orders from countries such as Ethiopia and Sudan, where demand for gold mining and infrastructure development equipment is soaring. In South America, especially in Ecuador, sales of large equipment have picked up, boosting profitability.

In China, the demand for small-sized equipment has increased and is expected to keep growing. This trend is driven by government initiatives that support infrastructure construction and a rising need to replace older equipment. Sales have risen by 4% year-on-year, and improved performance is anticipated in the future, especially following the consolidation of operations in China with HD Hyundai Infracore’s Yantai subsidiary.

In India, equipment sales have declined slightly after a period of rapid growth. Meanwhile, Brazil has seen a temporary increase in demand for construction equipment, driven by a surge in small- to medium-sized projects ahead of next year’s presidential election. As a result, overall sales have remained stable compared to the previous year. To enhance product competitiveness, the company plans to launch new offerings.

An official from HD Hyundai Construction Equipment stated, “The construction equipment market is shifting towards recovery after a performance rebound in the second quarter. We will enhance our cost competitiveness through specialized production at our global manufacturing hubs and continue to drive profitability with product portfolios tailored to specific regions.”

<E.O.D>

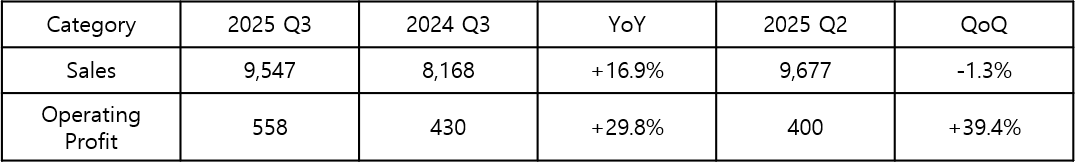

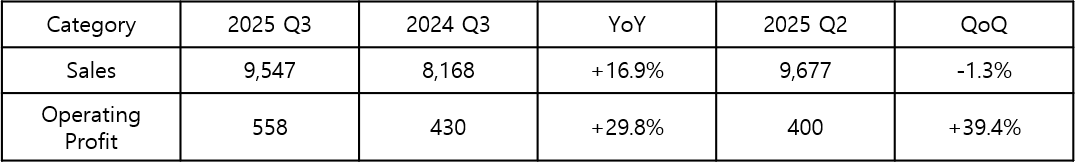

■ HD Hyundai Construction Equipment 2025 Q3 Results (Unit: KRW 100M)

▶ Increased Demand in Emerging Markets, Including Mining Equipment; Advanced Markets Also Showing Signs of Recovery

▶ “Aiming for Sustained Growth Through Specializing Production Across Global Bases and Tailored Product Portfolios by Sales Region”

On the 29th, HD Hyundai Construction Equipment announced that it recorded sales of 954.7 billion won and an operating profit of 55.8 billion won in the third quarter of 2025.

This marks a 17% year-on-year increase in sales, driven by surging demand in emerging markets, particularly for mining equipment, alongside a rebound in advanced markets. The operating profit rose by 30% year over year, supported by stronger sales and a product portfolio tailored to specific regions.

Regionally, advanced markets, particularly in North America and Europe, are seeing increased demand. Sales have benefited from higher sales of high-margin products, with Europe posting a remarkable 32% year-on-year increase and North America recording an 8% rise. Additionally, the After Market (AM) segment, which focuses on parts replacement and maintenance, has continued to improve profitability by diversifying its offerings, especially through a broader range of economical parts and oil sales.

In emerging markets, strong growth was observed across most regions, driven by heightened demand for mining equipment, ongoing infrastructure investments, and a robust construction sector. Notably, Africa saw an astonishing 216% increase in sales compared to the previous year, with significant orders from countries such as Ethiopia and Sudan, where demand for gold mining and infrastructure development equipment is soaring. In South America, especially in Ecuador, sales of large equipment have picked up, boosting profitability.

In China, the demand for small-sized equipment has increased and is expected to keep growing. This trend is driven by government initiatives that support infrastructure construction and a rising need to replace older equipment. Sales have risen by 4% year-on-year, and improved performance is anticipated in the future, especially following the consolidation of operations in China with HD Hyundai Infracore’s Yantai subsidiary.

In India, equipment sales have declined slightly after a period of rapid growth. Meanwhile, Brazil has seen a temporary increase in demand for construction equipment, driven by a surge in small- to medium-sized projects ahead of next year’s presidential election. As a result, overall sales have remained stable compared to the previous year. To enhance product competitiveness, the company plans to launch new offerings.

An official from HD Hyundai Construction Equipment stated, “The construction equipment market is shifting towards recovery after a performance rebound in the second quarter. We will enhance our cost competitiveness through specialized production at our global manufacturing hubs and continue to drive profitability with product portfolios tailored to specific regions.”

<E.O.D>

■ HD Hyundai Construction Equipment 2025 Q3 Results (Unit: KRW 100M)